Nuclear economics – reducing costs by managing the cost of capital

Of the many challenges to expanding the use of nuclear power, economic competitiveness is essential for future success. Nuclear projects are large complex projects that have frequently experienced delays and overruns. Earlier this year, we wrote about the need to build nuclear plants on time and on budget as the first step in making sure the economics of new build nuclear are robust. Improving the predictability of cost and schedule, i.e. making sure that when a project is approved, the costs and schedule are well understood and then they are reliably delivered, is a path to reducing the risk of these projects and securing public, government and investor confidence.

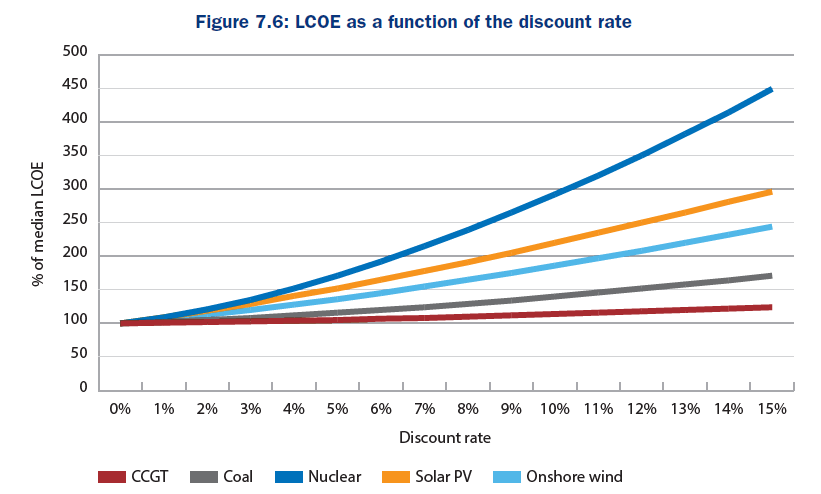

With project risk under control, the next step is to find ways to improve the overall economics of new nuclear plants. Studies have shown that the two largest drivers of the Levelized Cost of Electricity (LCOE) from a nuclear plant are the cost of capital and the capital cost. So today we will talk about lowering the cost of capital as a viable approach to improved economics and we will discuss ways to improve the capital cost in a future post. The diagram below shows the sensitivity of the cost of energy to the cost of capital from the OECD/NEA report Projected Costs of Electricity, 2015 Edition. As can be seen by the dark blue line, small changes in discount rate have relatively large impacts on the cost of energy.

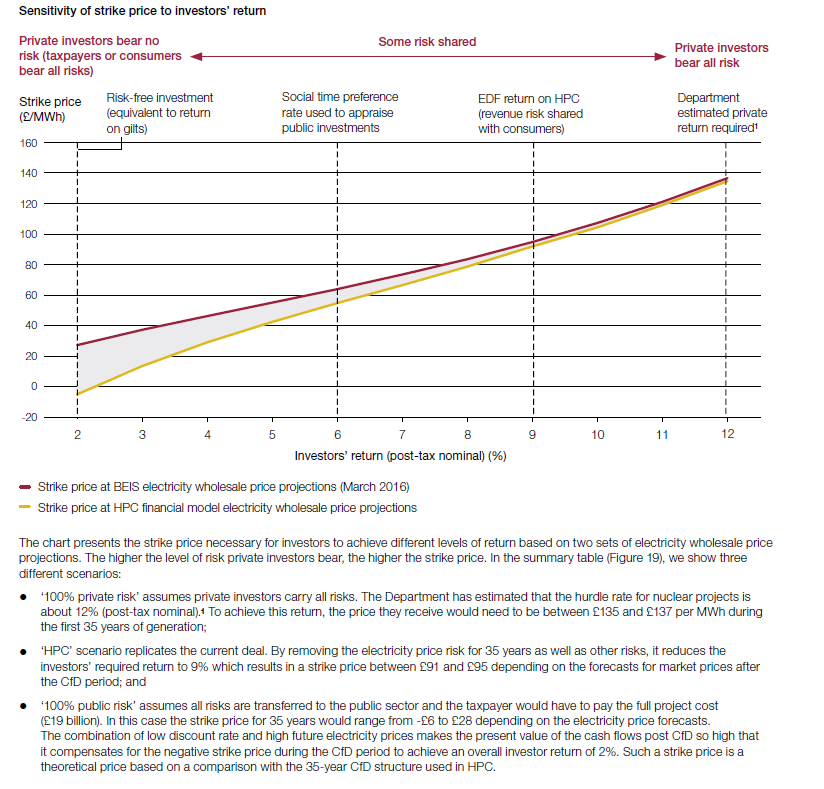

For this discussion we go to the UK, where its own National Accountability Office (NAO) did a review of the contract for difference model agreed to for the Hinkley Point C project. While it concluded the HPC deal is competitive in price and comparable in IRR to the 40 other similar contracts with low carbon generators, it noted that the economics have deteriorated since 2013 when negotiations occurred as the costs of some alternatives have improved. A construction risk analysis presented in an appendix to this report considered alternative models in which the UK government and consumers might choose to provide more support to arrive at lower energy costs. Consistent with the graph above, the NAO came to the same conclusion; that if a model can be developed with a different risk profile that reduces the cost of capital, the customer can benefit greatly through reduced energy costs.

This led to the UK government recently agreeing to a revised model for the upcoming Wylfa project to be implemented by Horizon Nuclear in Wales relative to that agreed for Hinkley C. By agreeing to some level of direct government investment, it reduced the cost of capital and is expecting the result to be a lower cost of energy. While Hinkley Point C has an agreed cost of £92.50 / MWh, it is anticipated that the Wylfa project may have a price in the range of £75 – 77 / MWh, a possible reduction of 15% or more in cost to the ratepayer. This is a game changer. By taking on a larger share of the risk, government can drive down energy costs. Of course, this also means that it must be comfortable that this risk can be effectively managed. This is likely as the private players, in this case Horizon nuclear, are still heavily incentivised to perform. It would also be recommended that government install some form of oversight on the project to stay informed of progress and to ensure that there is transparent reporting of its risks. It should be noted that this negotiation is not complete, and the final outcome is still unknown.

In fact, there is now thought that government should consider a regulated asset base (RAB) model further reducing the cost of capital and hence the cost of energy. A paper by Dieter Helm suggests the cost of energy can be greatly reduced if this model were to be considered. It is in common use in other utilities in the UK such as water and rail where long term assets are the norm.

The outcome would be nuclear projects with significantly lower energy costs. With appropriate risk management, it can easily be shown that the magnitude of the potential savings in energy cost is well worth the increased risk sharing. In other words, the private sector is charging too steep a risk premium to take on risks that are too long term in nature and difficult to price effectively. A more balanced approach to risk sharing could bring benefits to all stakeholders. Not everyone agrees. Government advisors of the National Infrastructure Commission have recently suggested slowing down nuclear approvals since renewables costs are improving faster than was previously anticipated. Of course, if renewables can improve, so can nuclear and this is exactly what the UK government is trying to support. If the nuclear cost can indeed come down so dramatically, then there is no reason to slow down as all good options for future generation are improving with time and the result will be a robust set of diverse generating options going forward.

For many years Government has been making investments in renewables to support their development as viable options for future generation primarily through direct subsidy. Following the commitment to Hinkley Point C, efforts are underway to develop policies that specifically target the unique challenges of nuclear power. These policies are creative ways to understand the investment and risk profile of nuclear and then address them in ways that are productive and continue to incentivize the private sector to perform.

Nuclear power is an essential tool in meeting the low carbon generation needs of the future. The UK government should be applauded for not only accepting this but now moving on to finding ways to improve this much needed option. The UK has got it right – focus on policies that reduce nuclear costs to customers and we all win.