MIT Report Update “The Future of Nuclear Power”

This week MIT released an update to its 2003 report, “The Future of Nuclear Power”. Back in 2003 this report brought the economics of nuclear power in the United States to the forefront. It supported new nuclear as a low carbon option for electricity generation and considered a scenario that would see the increase in capacity by a factor of 3 (meaning building about 200 new units) by the middle of this century. It is commonly accepted that this report was an important input into the policy that followed with respect to nuclear power including the nuclear power 2010 program and the Energy Policy Act of 2005.

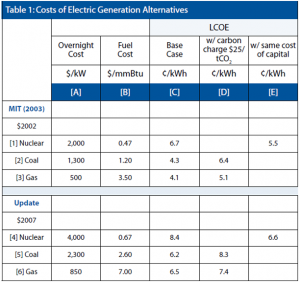

This update looks at progress over the past 6 years and of most interest, updates the economics. The following table from the report shows the new versus old analysis.

As can be seen, the costs have increased significantly over this time period with the projected costs of nuclear increasing faster than the costs of the coal and gas alternatives. However, the authors draw the same conclusions as they did in 2003; that nuclear is competitive with the alternatives. The report continues to assume a higher project risk for nuclear than fossil. This translates into a higher cost of capital and the highest cost of electricity. Assuming the same cost of capital as the alternatives results in nuclear being extremely competitive.

I want to comment on the costs and assumptions. I have to admit, that back in 2003, when I worked for a nuclear vendor, I was not happy with this report assuming nuclear at $2,000 /kW. At that time we all believed that we were making strides to lower the cost of new plants and we wanted to see that reflected in the analysis. Well, I was wrong. Today the cost of nuclear power has increased and I do accept that $4,000 /kW is a reasonable assumption to make in today’s world. Does that mean that I think that it is OK for nuclear plants to cost $4,000 /kW? I definitely think that more work needs to be done to bring these costs down but that is the subject for another discussion.

On the other hand, things have evolved so that the other assumptions do need to be challenged. While it may have made sense to assume different costs of capital in 2003, this is no longer the case. The argument in the report is based on the industry’s poor track record of building on time and on budget. It states that issues with new plants since that date confirm this and that the risk premium can only be eliminated with proven plant delivery performance. While I do agree that the industry needs to prove it can deliver a new fleet of plants to budget and schedule, things have changed since 2003.

In the current environment, the majority of new plants under consideration in the United States are with regulated utilities. These plants will be financed on balance sheet so they will be financed at the cost of capital of the utility itself, no different than if it were to build a coal or a gas plant. And now that the cost estimates have escalated significantly, it is reasonable to assume that part of this increase is due to utilities being more conservative and taking the risks into account in the cost estimates themselves.

Also, the risks of the alternatives have changed significantly. The risk of new climate change initiatives being put into place after the coal or gas plant is committed has increased. This means additional costs to the utilities to implement new carbon control requirements or charges due to additional costs for releasing carbon are likely. Is $25/t sufficient? At this stage nobody knows meaning higher risk.

And finally, it is interesting how the success of carbon capture and storage (CCS) is assumed, even though the technology has yet to be demonstrated while the success of building a new nuclear plant is consistently challenged. The MIT study itself recognizes that CCS is not proven. The costs of CCS seem to go up every time a new estimate is made, yet they assume that nuclear has a higher risk profile and cost of capital than coal with a yet to be proven technology attached to it.

In the case of a merchant plant, should there be one; it will very likely only be implemented under the US government loan guarantee program. This means that they can achieve the 80/20 debt/equity ratio assumed for the other technologies with even a lower potential cost due to the benefit of the government guarantee.

All that being said, the timing of this update is useful. Their conclusion that more needs to be done is important. As stated “The sober warning is that if more is not done, nuclear power will diminish as a practical and timely option for deployment at a scale that would constitute a material contribution to climate change risk mitigation.” It will be interesting to see how both government and industry respond.

1 Comment

Derrick Velazques · October 13, 2010 at 10:30 am

Hi please excuse my grammar, I am still learning. I found your article on “MIT Report Update “The Future of Nuclear Power” was essentially close to what I was seeking for, but after scanning through your story I still was not able find clean answer to my challenge and this is driving me cuckoo. I appreciate your website and think it is honestly handy but I think you could make it even better if you polish your website search to make it easier for people to locate needed information within your blog. You can do it very easy by adding wp addon… As far as I can remember addon was called “Search Everything” it has bunch of useful features like searching pages, search comments.

Comments are closed.