Happy New Year 2011!

Looking back at my blog from last January, I can probably start the same way – “Where did the time go?” 2010 has been a very busy year with a huge amount of activity in the nuclear sector around the world. I am certain that we can expect an even more active year in 2011.

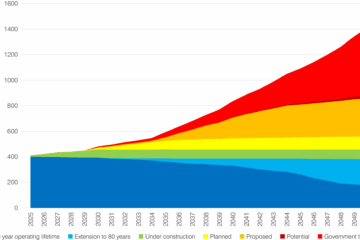

This year the industry movement from west to east has continued. Last year the success of the Koreans in the export market was the newsmaker – in 2010 it was all about China. China continued to expand its nuclear program increasing its target for 2020 to about 80 GW from the previous 40 GW. The first of its updated CPR 1000s came into service at Ling Ao 2 and there are now 13 nuclear units in operation (2 more than this time last year) and 27 units under construction (9 more units than at this time last year). And there is no sign of this program slowing down! In fact, it is continuing to accelerate with a target of bringing 10 units a year into operation from 2020 to 2030.

Of more importance, China has now expressed its intentions to start exporting nuclear plants by 2013. Work is currently under way to upgrade the CPR 1000 design to meet Generation III requirements. After having visited Daya Bay it is easy to see how this can become a successful export product for China. There has also been important progress in the first Asian nuclear export. The UAE announced that there has been progress on their project as the Koreans have now prepared and submitted the license application to the regulator for the first APR 1400 units to be build outside of Korea.

There is no better measure of the growth and breadth of the Asian nuclear programs than looking at progress with nuclear plant costs. Reports are that the cost of new plants continues to decrease while costs are increasing in the west. This is a direct result of the continuing strong commitment to new units and the large amount of experience being gained with each project.

Although things are moving more slowing in the west there has been some important progress. In the US, Southern Company has been granted its loan guarantee for the Vogtle Plant. On the other hand, issues with guarantee fees have caused Constellation to give up on its merchant plant at Calvert Cliffs. EDF is now looking to move forward without them. There has also been little progress in increasing the amount of loan guarantees available to the industry as a whole n the US. We expect to see good progress this year for the projects in both Georgia and South Carolina. The US is also putting significant effort into small reactors. There are a number of designs under development as the industry searches for a way to make nuclear power both more affordable and more attractive to a broader range of utilities.

In the UK, the Generic Design Assessment process has been progressing well. Similar to the US, the issues going forward with new build projects are related to the sharing of risk. Late in the year there was a significant breakthrough as the UK government embarked upon a consultation to make changes to the UK electricity market to make it easier for both nuclear and renewable projects to proceed as part of the UK’s carbon reduction policy. This consultation has a number of approaches to encourage large capital projects, the most important being the possibility of having a feed in tariff that applies to nuclear power plants. The consultation will close in March and I will likely write about this in more detail sometime soon.

In Canada, the year started with a number of issues related to nuclear refurbishments, radioisotope production and the future of AECL. However, later in the year, the refurbishment projects turned the corner as the Wolsong Unit in Korea was the first to complete its fuel channel installation and is expected to be back in service later this year. This has benefited the Point Lepreau refurbishment project where the issues facing the project have now been resolved. There has also been good progress at Bruce as the Unit 1 & 2 Restart project is nearing completion this year.

Of great importance, the middle of the year saw the NRU reactor go back into operation resuming the much needed production of medical isotopes after an extended outage and major repairs.

But the big issue in Canada remains the privatization of AECL. Originally expected to be completed within 2010 it is now expected that an announcement is imminent. Frankly it cannot come too soon for the Canadian industry.

And finally, the role of nuclear in reducing carbon has been accepted internationally. The IEA, in its 2010 World Energy Outlook (WEO), see an important role for nuclear. And of more importance, mid year they published the “Nuclear Roadmap” showing the potential role that nuclear can really play in achieving global carbon reduction objectives. This scenario has nuclear increasing from its current 14% of global production to about 24% by 2050 and has a scenario going all the way to 38%.

Definitely it was another busy year for the nuclear industry. And it looks like things are only going to continue in 2011. More growth in Asia is a given. Breakthroughs in the US and UK are likely and big decisions are coming for the Canadian industry. And I have not even mentioned the numerous other countries that are now studying and moving forward with plans to consider new nuclear plants.

So Happy New Year to all and lets get ready for an exciting 2011.