Abundant and economic – Nuclear power delivers

The past few weeks have seen lots of excitement as the world reached agreement to tackle climate change in Paris. What is key to the Paris deal is a requirement that every nation (all 195 of them) take part. Ahead of the talks, governments of 186 nations put forth public plans detailing how they would cut carbon emissions over the next 10 to 15 years. However, these plans alone, should they come to fruition, will cut emissions by only half the levels required to meet the targets set out in the agreement. The plans vary significantly from country to country with some like China depending upon nuclear power as part of their plan – and others not. With no concrete plan to achieve the goals in the agreement, one thing is clear; that if there is any chance of meeting these ambitious goals, there will have to be a larger role for nuclear power.

Critics of nuclear power generally focus on two main issues: safety, mostly concern that the consequences of a possible nuclear accident are not worth the risk; and cost, with many noting that nuclear is a high cost option that just diverts funds from the real environmental options for future generation, wind and solar. This month we will talk about cost and how to ensure that nuclear is seen for what it is, a capital intensive yet highly economic option for reliable 24/7 generation. If nuclear is to play the role that it can, and must play in the future generation mix, it can only get there by being the economic option of choice.

In our last post we noted the updated version of “Project Costs of Electricity” has recently been published. This is an important report that is now in its 8th edition from the IEA and NEA looking at the costs of various forms of electricity generation.

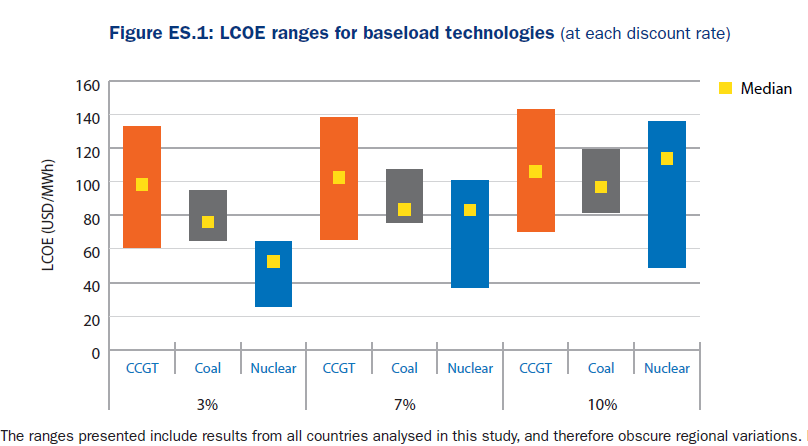

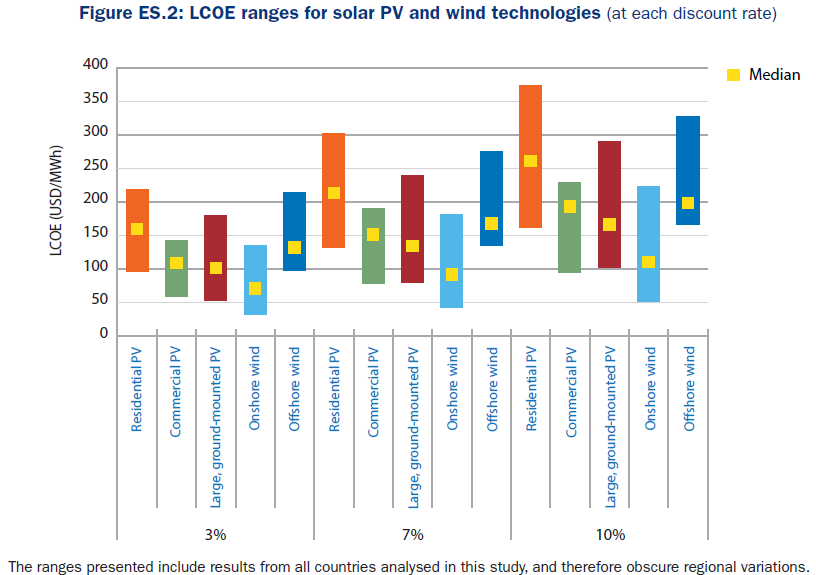

The results of this study are very clear. It shows that nuclear is a very competitive option on a Levelized Cost of Electricity (LCOE) basis.

In fact, at low discount rates (3%), it is the clear winner among both traditional fossil technologies and the cost of renewables. While the report acknowledges the huge gains made by renewables in reducing their costs, it also notes the belief that nuclear costs continue to rise is false.

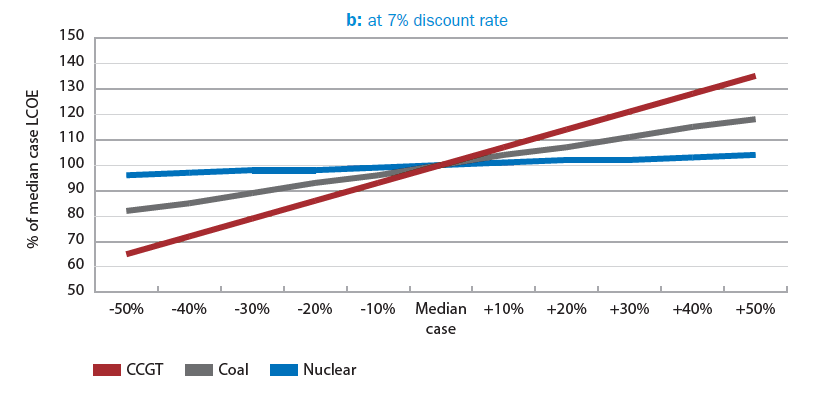

What is of interest is how the results are presented. The main comparisons in the executive summary are provided varying only one parameter, discount rates, that range from 3% to 10%. This represents a three-fold increase in the discount rate over the range. It is therefore not surprising that the technologies that are capital intensive, i.e. nuclear and renewables show the greatest sensitivity to this one parameter. This is one way to look at the comparative economics. On the other hand, generating stations powered by fuels like coal and gas are much more sensitive to fuel price. This sensitivity is only shown later on in the report in a sensitivity section.

Figure 7.12: LCOE as a function of fuel cost

So for example, while gas plants (CCGT) vary little with discount rates due to their relatively low capital costs and higher fuel costs, their LCOE is very sensitive to fuel prices. In the chart above, the sensitivity only varies fuel prices by up to 50%; rather small in comparison to the three-fold change in discount rates in the earlier chart. Yet we all know that today’s very low gas prices in North America are easily less than half as much as they were only a few years ago. Doubling gas prices or more would have a huge impact on electricity costs.

As would be expected, the economics also vary by region. It is no accident that China is building the most nuclear plants in the world. Even though they are also building many more coal plants to meet their ever increasing hunger for energy, nuclear plants provide clean reliable energy at about half the cost of coal in China making it an easy decision to move forward with new nuclear plants as quickly as they can. On the other hand, this past month we have once again heard about nuclear plants in the United States that are likely going to close prematurely due to poor economics. This results mostly from very low gas prices that impact the economics in those parts of the country that have open competitive markets. The units that are most impacted are the older smaller single unit stations that are requiring capital investment at this stage of their life cycle. Without any acknowledgement of the low carbon characteristics of nuclear, or the reliability of fuel supply (gas plants generally are fed by pipelines that are at risk in cold winter months), these units are struggling. Yet the industry in the USA is not standing still. As reported in the December 10 Nucleonics Week, the US industry is targeting to reduce its costs for the existing fleet by 30%. Once achieved, this will ensure that once again nuclear will be the lowest cost generation on the system.

However, this is only the first step. Being a low carbon generator is only sufficient to ensure that nuclear remains an option. The key to long term success is the ability to reduce the capital costs of constructing the plant; producing low cost energy is what will really drive a strong new build program. This can be seen in countries such as China and Korea, where capital costs are relatively low, making nuclear by far the most economic option available. Lessons learned in these markets must be shared and implemented globally to bring down capital costs in other markets as well. China and Korea are showing the way. If the rest of the world follows, abundant nuclear power will play a large role in tackling climate change as the electrical grid workhorse of reliable low-carbon and mostly, economic generation, for decades to come.