Saving the planet step 2 – let’s build as many Generation III nuclear plants as we can

It has been more than a decade since the nuclear industry focused

its attention on the next generation of nuclear plants, the Generation III

designs. Most of the world’s current operating

fleet (440 nuclear reactors in 30 countries) are classified as Generation II

plants, the first generation of truly commercial nuclear generating stations

(Generation I were the early demonstration units). The idea behind Generation III was to take

the lessons learned from the many years of operation of these plants and design

the next evolution of nuclear; new plants that would be more cost effective to

build, easier to operate and safer than their predecessors.

But these new designs did not progress as easily as their designers

envisaged. In many cases there were

delays in getting approvals, delays in construction and cost overruns. A decade passed and there were still no Gen

III plants in operation – until now. In

the past year or so, not only did one of these designs come into service, most

of them did.

Here is the list of newly operating Gen III nuclear plants:

- 4 AP1000 units operating at Haiyang and Sanmen

China - 2 VVER 1200 units operating in Russia

- 2 EPR units operating in China

- 2 APR1400 units operating in Korea

- 2 ACPR1000 unit operating in China

And there are many more on the way. EPRs in Finland and France. APR1400s in Korea and UAE, VVER 1200s in

Russia, Turkey and Bangladesh, AP1000s in the United States, and the new

Hualong One design in China which is nearing its first unit completion to name

a few.

Why is this important?

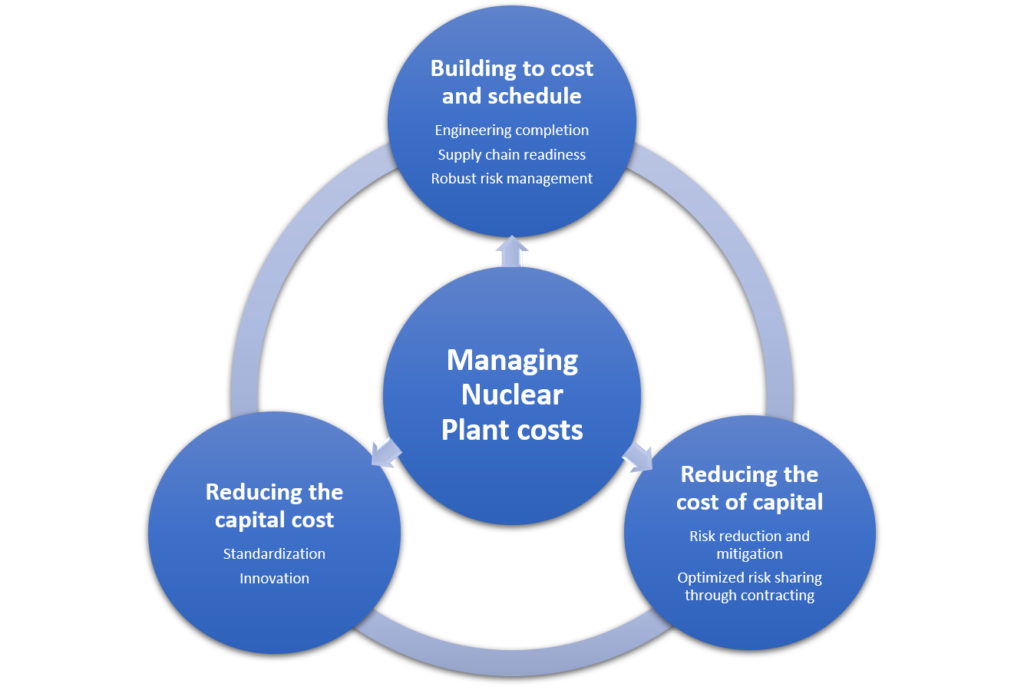

We have often talked about building fleets of standardized nuclear

plants to control both cost and risk and now these designs all have their First

of a Kind (FOAK) challenges behind them.

This means the industry has never been in a better position to move

forward with large standardized fleets to take advantage of all the lessons learned

and the ready supply chains. And with a

number of designs to choose from, there are options for everyone while maintaining

a healthy competition amongst the vendors.

Governments are getting ready too. For example, recently the French government instructed

EDF to prepare a plan for another 6 EPR units in France and India is preparing

a site for 6 AP1000s.

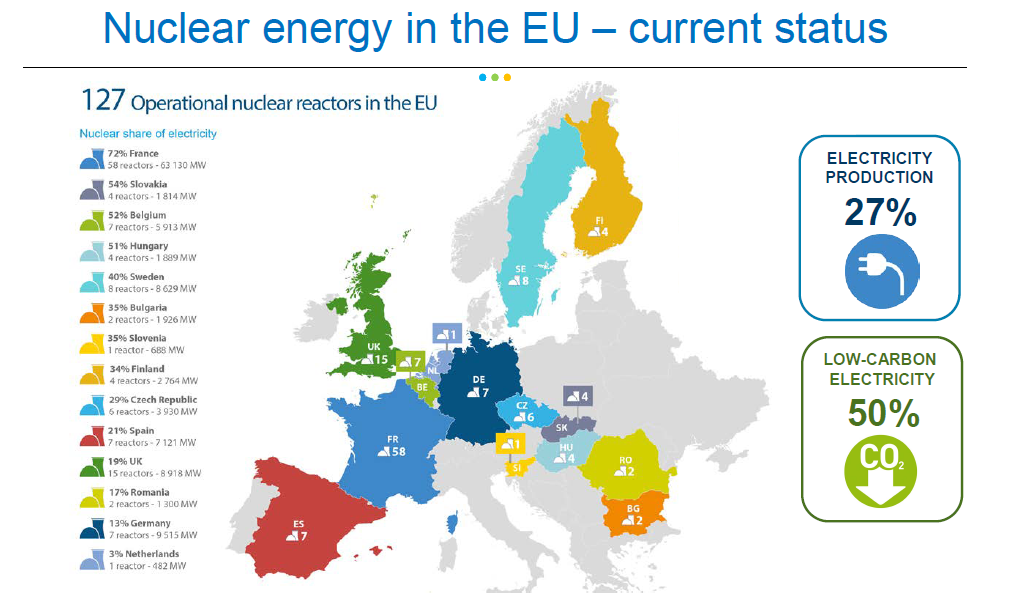

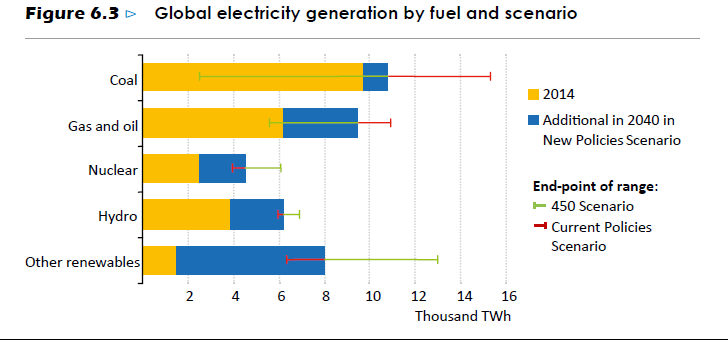

And the need couldn’t be greater, as the just released 2019 edition of the World Energy Outlook (WEO) shows how the world is struggling to find a way to meet carbon emission targets. There are no easy answers. It states, “More than ever, energy decision makers need to take a hard, evidence-based look at where they stand and the implications of the choices they make.” Even assuming a massive new build renewables program with solar growing its capacity by an order of magnitude, from about 500 GW today to almost 5,000 GW by 2040 the challenge is that “the momentum behind clean energy technologies is not enough to offset the effects of an expanding global economy and growing population.” So, as it did last year, in order to meet the emission targets in its sustainable development scenario, it assumes very aggressive energy efficiency to eliminate the projected 24% increase in energy demand growth to 2040 from its stated policy scenario. Now, does anyone really believe in 20 years time we will be using less energy than we do today? The conclusion is clear. Renewables cannot meet the challenge alone.

Our Generation III plants are here and ready to make their contribution to meeting the low carbon energy challenge. So, as we wrote before, if step 1 to saving the planet was to keep the current nuclear fleet operating as long as possible to avoid going backwards by having to replace one low carbon source with another, then step 2 becomes obvious – in addition to a rapid build of renewables, build as much more nuclear as we can. Keep in mind that the difference in efficiency means that every new GW of nuclear (typical size of Gen III reactor) is equivalent to about 5 GW of solar, not to mention the battery storage required to ensure the solar energy can be used when needed, not just when the sun shines.

Having been the largest source of low carbon electricity generation over the last 50 years in advanced economies, nuclear is already an indispensable part of the world’s low carbon energy system. As an industry, it’s time to show what we can really do to play an increasing role in meeting the challenges of the future. We are making progress. In 2018 10.4 GW of new nuclear were added to the global grid. Let’s keep going and scale up our efforts to meet the industry Harmony goal of nuclear providing 25% of the electricity supply by 2050. With a full suite of Generation III designs up and running and an industry ready to go, all that is left to do is build, build and build some more.

[Note: for those of you wondering how small modular reactors

(SMRs) fit into this picture, you will have to wait until we discuss Step 3 to

saving the planet in a future post]