It is broken markets, not uneconomic plants that are putting nuclear plants at risk

A huge milestone has been achieved in the United States as Watts Bar Unit 2 produced its first electricity; becoming the first new nuclear plant in the US to start up in 20 years since Watts Bar Unit 1 came into service in 1996. Unfortunately, this good news was overshadowed by the announcement by Exelon that its Quad Cities and Clinton power stations in Illinois would close. This decision was the most recent but not the first, with headlines such as “Nuclear plants need boost to stay open, industry warns” or” Nuclear power plants warn of closure crisis” pointing to more nuclear plants that are at risk of premature closure because they are no longer economic in the competitive markets in which they operate.

Watts Bar – America’s newest nuclear plant

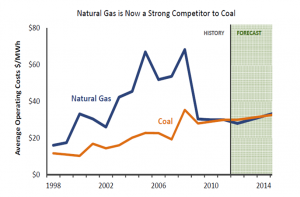

There are many explanations as to the cause of this “crisis”. Gas prices are currently very low, renewables are subsidized and the costs of some of the smaller oldest single unit nuclear plants in the country have been rising as they age. While all of these points are true, they are not in and of themselves, the direct cause of the problem. They are symptoms of deep structural issues in those parts of the country where electricity is bought and sold in so called open or deregulated markets.(Note: Watts Bar, owned by the Tennessee Valley Authority, is in a regulated market.)

This was the topic of a recent DOE summit on how to “save” the nuclear fleet (“Summit on Improving the Economics of America’s Nuclear Power Plants”) to address the crisis and take steps to avoid the unnecessary closing of a significant number of plants. So here we are and once again, we fall into the trap of incorrectly defining the problem as costly inefficient nuclear plants. After all the US summit is on how to improve the economics of nuclear plants, not how to fix poorly structured markets – the real problem. (Note: In Europe there are similar issues driven by a high level of subsidized renewables rather than low gas prices. But the need to find a solution is the same. A European Commission official assured delegates at a recent nuclear financing conference held in Paris that the design of European wholesale electricity markets and the emissions trading system (EU ETS) will be improved to help – and no longer hinder – nuclear energy as a low-carbon source of electricity.)

In the guise of providing the lowest cost to ratepayers, most markets are completely focused on the short term. There is little consideration of risk built into the pricing mechanisms, only what is the lowest cost to generate electricity right now. This means that there is no value attributed to any of the other important operating attributes required for a reliable and secure electricity supply system such as fuel availability, maneuverability, flexibility and price volatility. On top of this, things like government environmental policies and subsidies further distort the markets to ensure that mandated renewables have a role in the system. (Of course nuclear has not benefited from such support even though it is a low carbon option.)

This may have all worked fine 25 years ago when markets were opened with the objective of creating efficiencies in the existing operating fleet –a time when many jurisdictions were in oversupply. But when it comes to adding capacity or making other substantive changes to the system, electricity markets are not nimble. While there may be a desire to respond to price signals in the short term, building new plant takes time. And one thing is for sure, no one will build new plant of any kind without some confidence that they will generate sufficient revenue to operate for their projected lives and earn a return on their investment. Or as stated in the OECD report Project Costs of Electricity, “The structure of the electricity generation mix, as well as the electricity demand pattern, is quite inelastic in the short term: existing power plants have long lifetimes and building new capacity and transmission infrastructure may require a considerable lead time as well as significant upfront investments. In other terms, electricity systems are locked in with their existing generation mix and infrastructure, and cannot quickly adapt them to changing market conditions.”

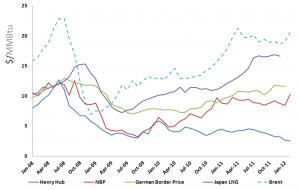

It is also important to understand that not all market participants are equal. In most markets gas is the price maker, not a price taker. So when gas prices are high, everybody else in the market makes money and when gas prices are low, everybody struggles. And yes, today gas prices are very very low. Yet gas operators are relatively indifferent as they are the risk free players in the market. Even in this enviable position, gas generators did not have sufficient incentive to build new plant, so many markets have responded with the development of capacity markets. These capacity payments then compensate gas plants for sitting idle – effectively removing the risk to gas generators of building new plants.

So you may ask, what’s the problem with that as long as we have low energy prices?

If open markets are so efficient then we should expect that prices in these areas should be lower than in areas where regulated markets have remained. Not so, says an April 2015 study by the American Public Power Association. In fact, in 2014 prices in de-regulated markets were as much as 35% more than those in regulated states. (Note: this study has been done by an organization with an interest in the result and as such may contain bias.)

So let’s go back to electricity system structuring. When it comes to managing risk, we know risk is generally reduced through a diverse portfolio of alternatives. The more diverse, the more risk can be reduced. The current path will result in systems that are not diverse, but rather all gas, currently the most economic alternative. If markets do not adapt to better accommodate risk management into their pricing strategies, we face a future of volatile energy prices, possible energy shortages as new plant construction lags market needs and increases rather than decreases in carbon emissions; all in the guise of more efficient markets. Back to the decision in Illinois. As stated in the referenced article, not only are these two plants Exelon’s best performers, they “support approximately 4,200 direct and indirect jobs and produce more than $1.2 billion in economic activity annually. A state report found that closing the plants would increase wholesale energy costs for the region by $439 million to $645 million annually. The report also found that keeping the plants open would avoid $10 billion in economic damages associated with higher carbon emissions over 10 years.”

We only need one major market disruption to remind us all of the importance of truly reliable baseload power at a stable and economic price and how that protects us from the risk of higher prices and lower security of supply. And today, there is only one low carbon highly reliable baseload option, nuclear power.

So while a short term fix to keep operating nuclear plants open is required and more urgent than ever, let’s stop talking about how plants are uneconomic and work to properly improve market structures to build and maintain the strong, reliable, economic and low carbon systems needed to power our modern economies.