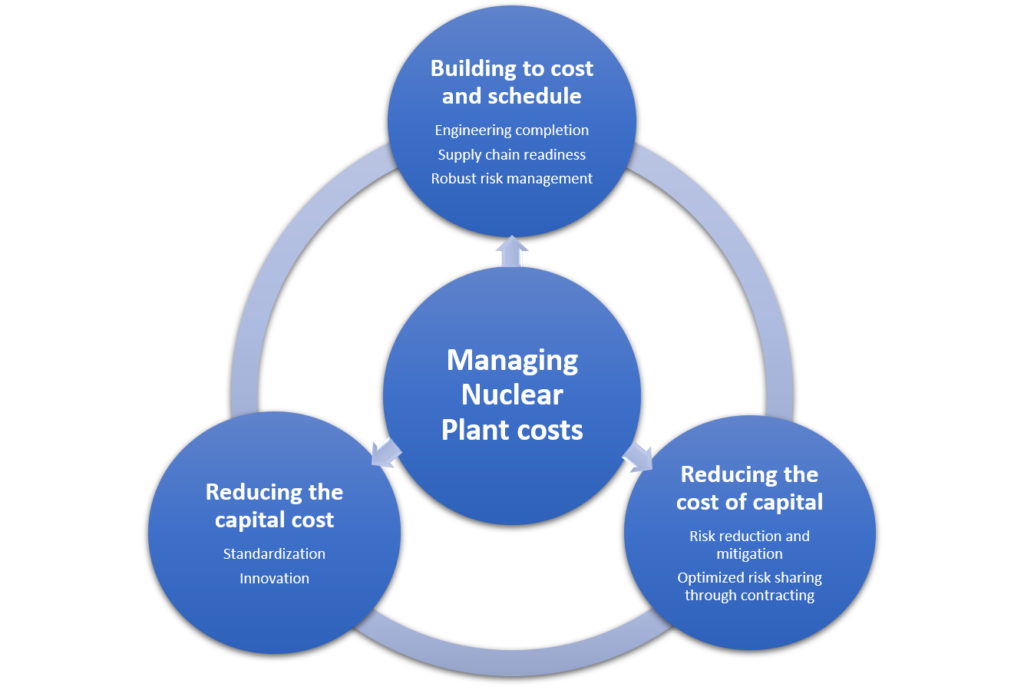

Nuclear project structures – it’s about managing risk

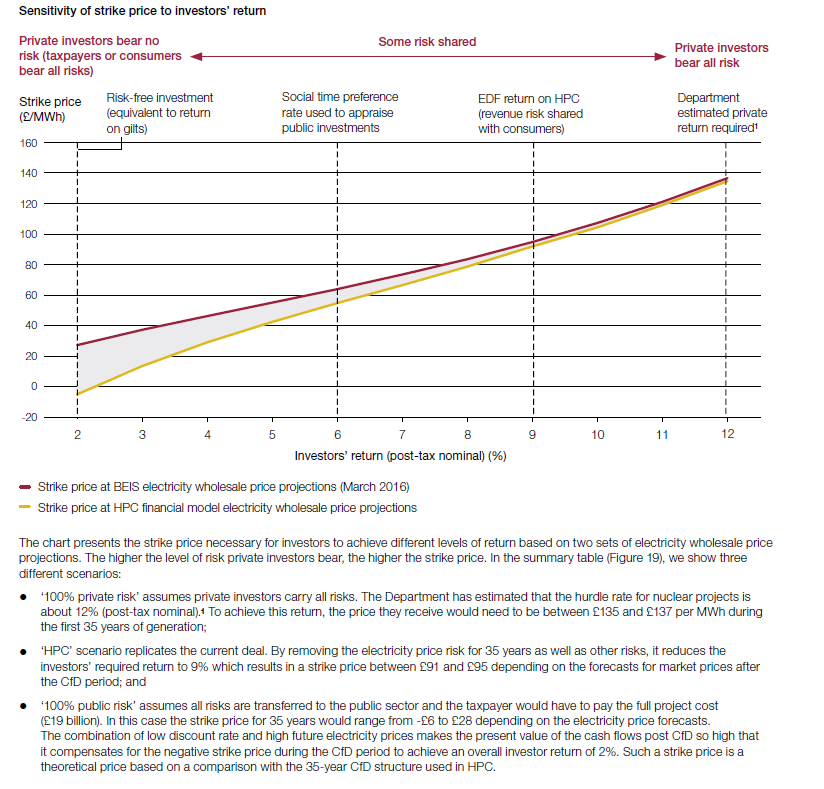

In our recent post on nuclear project financing, we noted the importance of reducing risk to investors to ensure projects can raise sufficient competitively priced capital needed to build them. Today we will discuss project structures. What are they and why are they important?

The project structure is how the project is organized contractually to build the plant and then sell the electricity to the market. Good structures help the project to succeed while poor ones end up with lawyers arguing where to lay blame rather than people delivering on their commitments.

There are four major categories of participants in a large energy project.

- The customer – who needs the energy and pays for it to be reliably delivered to their home or business;

- The owner/operator (yes these can be separated, but we will keep them together for simplicity), who is responsible for building and operating a generating station to provide the energy to the customer;

- The contractor(s), who have technology, design, and construction capabilities to build the plant; and

- The investors, who provide the funding to support this construction and who will be repaid during plant operations when there are revenues from selling electricity.

When talking about contractual structures, the primary relationships are between the owner/operator and the customer (market structure); and between the owner/operator and the contractor (project structure).

There are a whole range of contractual structures for both relationships. Some are simple and some are complex. None are perfect. Historically, electric utilities tended to be vertically integrated monopolistic companies, often owned by governments, who were charged with delivering electricity to customers at low cost. Utilities carried most project risks and passed them on to the customers. A government regulator was charged with setting rates for customers (while looking out for their best interests) based on the utility costs and performance.

Poor project performance and a belief that competition would incent better results led to a shift to deregulated markets in many jurisdictions in the early 1990s whereby the utilities would be broken up and generators would have to compete to sell their electricity to the market. (We wrote a previous post on why these deregulated markets do not work well for building new low carbon generation.)

Being forced to take on more risk by their customers, owners wanted more certainty of outcomes and believed contractors, as the experts in performing the work, were in the best position to take on these risks. Wanting this work, contractors agreed to take on more project risk, for a price. This provided a sense of security to the owners that their risk was limited, and that they could rest easy, knowing it would be up to others to ensure successful project delivery.

Unfortunately, this has been proven to be nothing more than an illusion. In reality, the contractor’s ability to take on additional risk is limited and when project costs increase, they will generally make a claim for a change in scope requiring additional funds. This often results in contractual disputes that slow down project progress and negatively impact company relationships. In the end, there is no escaping the project risks for the owner, as it is their project and their money. After all, there is no scenario where the contractor fails, and the project succeeds.

The lesson is that when developing project structures, the objective is to manage risk while incentivising the behaviours from the project stakeholders necessary for project success; not to decide who suffers the most in the case of failure. Because for long term commercial success, there is one truth. All costs must be borne by the customer. There is no one else (unless government provides a subsidy in which case taxpayers are involved which is a different discussion – we will talk about the potential role of government in mitigating risk in a future post). When the investors state that they do not want to be exposed to excessive risk, what they mean is that they want a credit worthy borrower who can reliably replay loans and deliver a return on equity. And while ensuring they are contractually protected from risk is important, the best way forward is to confidently deliver projects to cost and schedule.

This is changing the way that projects are structured to more collaborative models whereby all parties’ objectives are aligned, and everyone sinks or swims together. Good project contracting is important in defining the project, but on its own is insufficient to ensure good project outcomes. Successful project delivery results from good project planning, doing enough work upfront to set a realistic cost and schedule; and excellent project management, supported by a high level of transparency together with a strong set of project metrics to enable informed rapid decision making to keep the cost and schedule under control. Continuously improving the ability to deliver successful projects to cost and schedule will ensure that nuclear power can meet its full potential on the road to a Net Zero future.