The challenge of financing nuclear plants – financing energy requires huge investment

Quite often we hear about the problem of attracting financing to support new build nuclear projects. In fact financing will be a topic of major interest at a number of upcoming nuclear conferences. While it is easy to agree that financing nuclear projects is a big challenge, in my view difficulty securing financing is not the issue – rather it is a symptom of a number of other very important issues that are the root cause. Necessary conditions to secure financing for any project is first and foremost, an economically viable project. Next comes the project structure – or to state it more simply – ensuring the risks are managed in a way that can satisfy investors that they will receive an adequate return for their investment. These concepts will be discussed further in a future post.

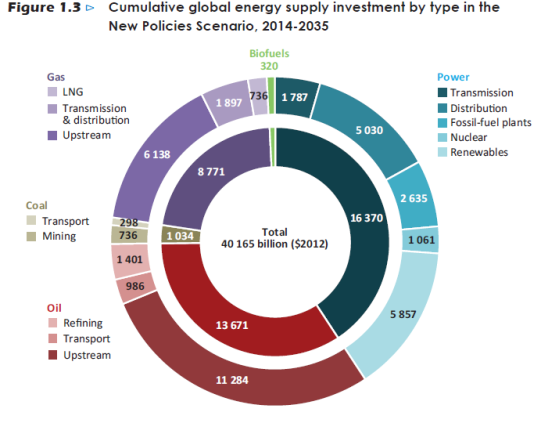

For today, I will look at the $40 trillion energy industry and consider nuclear’s share of the overall expenditure needed for energy over the next 20 years. I would like to put some context on the issues related to financing nuclear plants by looking at a recent IEA report called the “World Energy Investment Outlook” or WEIO. I found this report of interest because it provides useful data on global funding required to support energy. Or as stated in the Forward to the report “…. data on today’s investment flows have not been readily available and projections and costs for tomorrow’s investment needs are often absent from the debate about the future of the energy sector.”

We often talk about the large size of nuclear projects and how they require huge amounts of funds. Nuclear projects are very capital intensive and have relatively long project schedules; both important issues when trying to secure financing. When we talk about large, a good first step is to try and understand how much funding is required for nuclear projects relative to the rest of the energy industry. And for this we turn to the WEIO.

With annual spending in 2013 of $1.6 trillion rising to about $2.0 trillion by 2035, meeting global demand for energy requires an enormous amount of money. This excludes another $500 billion or so per year to be spent on energy efficiency to try and moderate this growing demand.

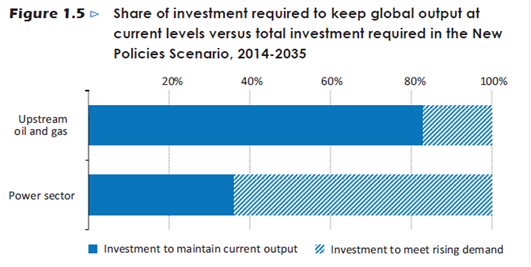

Of even more interest, the report specifies that less than half of the $40 trillion dollars required to meet energy demand between today and 2035 goes to meet demand growth; the larger share is required to offset declining production from existing oil and gas fields and to replace power plants and other assets that reach the end of their productive life.

A staggering statistic – more than $20 trillion is required over the next 20 years just to stand still. And of course, most of this investment is in fossil fuels that continue to emit carbon as the world tries to find a way to turn the corner and find alternatives.

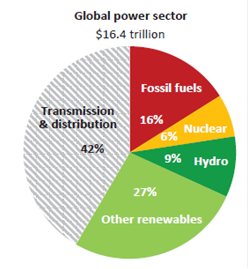

If we drill down and focus on the electricity sector, we can see that of the above $40 trillion about $16.4 trillion is investment in the electricity sector. The largest component of this investment (about 40%) is in transmission and distribution. In the developed world this essential infrastructure is ageing and requires significant investment to meet growing needs. In the developing world, there is a huge need to build up the infrastructure for a population hungry to enjoy the benefits of using electricity.

Looking further we can see two important facts. First, nuclear power only needs about 6% of the funds for the electricity sector; this is assuming the very modest growth for nuclear in the WEO New Policy Scenario. The other is that renewables are demanding a very large share of the available funds as more and more markets turn to these forms of energy to meet their growing energy needs while trying to curb carbon emissions.

What can we learn from this high level look at the funding requirements for the energy industry? On the one hand, nuclear projects require only a very small portion of the total funds being invested today and for the next 20 years in energy. The main uses of funds are to replace existing depleted fossil fuel reserves – usually at a cost higher than the resources they replace; to invest in critical T&D infrastructure, in part due to the need to expand transmission to be able to accommodate renewable energy generation; and the investment in renewable energy generation itself, virtually all of this last investment subsidized by governments to encourage growth.

On the one hand, there is tremendous competition for funds in the energy industry meaning nuclear projects need to be an attractive financial proposition to get its share of these funds. And on the other hand, much of the competing technologies are being supported by governments with subsidies based on policy decisions.

So what is it that makes nuclear plants so difficult to finance? As I said at the start of this post, there are a number of issues that need to be discussed. These include project economics, energy market structures, poor project construction performance in a number of markets; and of course, public perception that skews the risk profile of nuclear projects in a way not seen in other industries. But a discussion of these factors will have to wait until another time…….

Note: all figures above are from the IEA World Energy Investment Outlook.

3 Comments

Paul Murphy · August 25, 2014 at 11:21 am

Nice note.

If you ever want to collaborate on a nuclear financing discussion, I’d be very interested.

Regards,

Paul

Doug Hink · August 25, 2014 at 3:16 pm

Hi Milton,

I hope all is well. Just want to say that this is a very interesting and in my view accurate analysis of the situation and where nuclear fits in. I wonder, however, if renewables do not step up to the plate with their 27% of the supply (at higher but manageable cost) what will be the impact on the economic base of major economies, because the effect will surely have to be significantly higher costs rippling through the economy.

Enjoy the conference. I was unable to make it but perhaps we should meet and talk about areas of mutual interest when you return and can find a minute.

Doug

Ian Emsley · August 26, 2014 at 6:01 am

The huge investment challenge in the power sector boils down in large part to the huge challenge of financing costly renewable technologies with their high systems costs for backup and transmission capacity. Yet, according to the 2013 WEO in the New Policies Scenario, by 2030 non-hydro renewables are supplying only marginally more power than nuclear. Given the dependence of renewables on subsidy and costly market arrangements and given the fiscal challenges facing governments, there seems more than a negligible chance that renewables will not attract the necessary finance. Perhaps it is renewables that have the financing challenge more than nuclear.

Comments are closed.