Nuclear competitiveness and the folly of forecasting

Hard to believe we have already come to the end of another year. It was a year with both highs and lows for the nuclear industry. I will talk about this more in the new year. But for today, I wanted to close out 2012 by writing about something that I have been thinking about since I first addressed it in September of 2011 – gas prices.

It was about a year and a half ago when the then president of Exelon gave a speech to the ANS noting that “Nuclear is a business, not a religion”. The premise was that nuclear needs sustained high gas prices to be competitive. Since that time it has become a given that gas prices in North America are low and predicted to stay low for some time; the result being that new build nuclear plants are not competitive in this environment. It is said in almost every article and discussion of the future of nuclear in North America. i.e. we love nuclear but low gas prices are making it impossible at the moment (albeit more in the US than in Canada).

And indeed, this was the year that gas prices seemed to go lower than anyone could have imagined. Earlier this year the price actually dropped below $2/mmBTU and has stayed roughly in the mid $3 range ever since.

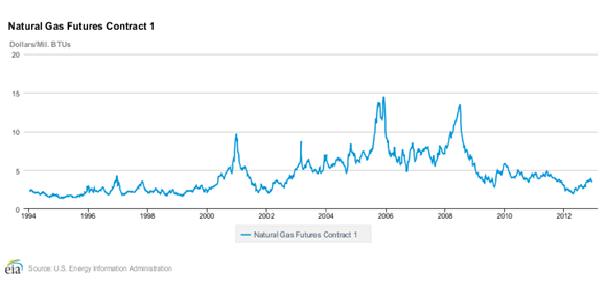

But this is the point. Predictions are just that – predictions – and in most cases are notoriously wrong. Just look at the change in prices from 2008 until now. And I can assure you that in 2008 no one was predicting this to be the case.

I first cited Dan Gardner’s book “Future Babble” in my post of August this year. I loved this book. It was good fun to read and I strongly recommend it. Basically the book explains why expert predictions fail and why we believe them anyway. It includes some fun anecdotal examples. “In 1984, the Economist asked sixteen people to make ten-year forecasts of economic growth rates, inflation rates, exchange rates, oil prices, and other staples of economic prognostication. Four of the test subjects were former finance ministers, four were chairmen of multinational companies, four were economics students at Oxford University, and four were, to use the English vernacular, London dustmen. A decade later, the Economist reviewed the forecasts and discovered they were, on average, awful. But some were more awful than others: The dustmen tied the corporate chairmen for first place, while the finance ministers came last.”

And while giving examples of where expert predictions are wrong is fun, Future Babble does actually quote a bone fide study on the issue. This study comes from Philip Tetlock who today, is a much-honoured psychologist at the University of California’s Haas School of Business. In 1984 Tetlock undertook a massive study on just this issue.

”Scouring his multidisciplinary networks, Tetlock recruited 284 experts — political scientists, economists, and journalists — whose jobs involve commenting or giving advice on political or economic trends. All were guaranteed anonymity because Tetlock didn’t want anyone feeling pressure to conform or worrying about what their predictions would do to their reputations. With names unknown, all were free to judge as best they could.

Then the predictions began. Over many years, Tetlock and his team peppered the experts with questions. In all, they collected an astonishing 27,450 judgements about the future. It was by far the biggest exercise of its kind ever, and the results were startlingly clear. The experts beat the chimp by a whisker. The simple and disturbing truth is that the experts’ predictions were no more accurate than random guesses.”

The reality of successful forecasting is captured in what I find to be a very funny current ad by Ally Bank in the US.

http://youtu.be/lu6MwbYsoxI

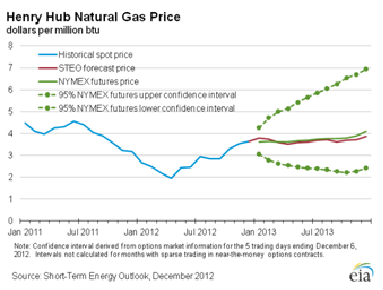

So what can we conclude from this discussion on the folly of predictions? What will gas prices be in a decade? Nobody knows. Period. Look at the history of gas prices. In the last twenty years about half the time prices have been below $5/mmBTU and about half the time above. The second graph is even more telling. Even with scores of predictions that prices will remain low for some time, forecasts by the EIA (US DOE) show that over the next six months or so there is a 95% confidence level that prices will be somewhere between $2 and $7/mmBTU, pretty much the same as they have been over the last twenty years with a few exceptions.

Source: DOE EIA

While this is all in good fun – after all, it is the holidays – why am I discussing this and what does it mean for the future of nuclear in North America? I guess I need to get a bit serious to close out the year and give you something to think about as we move into 2013.

So here are some truths:

- Most nuclear plants in operation today are competitive as they are the lowest marginal cost producers in almost every market (and they were all built in a lower gas price environment)

- New build nuclear is currently not competitive with $3/mmBTU gas

- In a previous post, I showed that new nuclear in the US does well against $7 gas in the OECD./NEA report issued in 2010. If we are able to reduce capital costs due to the benefits of series build (after FOAK projects), then new build nuclear should be able to compete with gas in the $5/mmBTU plus range.

The conclusion of this is that nuclear is competitive with gas over much of the range that gas prices are likely to be. It struggles at the bottom, but excels at the top. So a general conclusion is that a nuclear power is expected to be a competitive option for the future and as such, would be a reasonable part of any electricity supply system. This is the rationale for new plants currently being built in South Carolina and Georgia.

Now the real issue. Nuclear plants take about 8 to 10 years to implement. Do we have any idea what gas prices will be in a decade? No we do not. In fact we don’t even know what gas prices will be next year. But we do know that overall, whatever they may be, nuclear plants will produce electricity at a cost that is within a reasonable range of gas and other alternatives. And hence the issue. If we can’t predict electricity prices next week, how can we ever make the decision to build a plant that will come into service post 2020?

This is where we need to question the current structure of the competitive electricity markets (which I have long said are really gas markets) [Note: the UK is struggling with just this issue at the moment as they work to move forward with new nuclear]. While the lowest cost at any time is a commendable objective, we must also accept that we do not want an electricity system with only one form of generation – and it is a truth that, at any point in time, only one form of generation can be the least cost option. Add to this the fact that it takes time to build electricity generation and we can easily see how it is so difficult to take investment decisions, especially for capital intensive long schedule options like nuclear power. The world is readily accepting that subsidies must be paid to encourage the use of renewables – and we certainly know that fossil fuels are heavily subsidized in many markets. So what about nuclear?

We also know that today in Germany and Japan (at least temporarily), where decisions to not operate nuclear plants have been taken, costs have gone up with a huge impact to the local economies. In fact high energy prices are becoming a very significant issue in Europe as recently reported in the NY Times.

So given we want an electricity generation system that is at least somewhat diversified and not totally dependent upon one form of generation, let’s consider the long term benefits of nuclear power:

- Highly reliable and stable production

- Extremely energy dense producing huge amounts of energy from relatively small amounts of fuel.

- Relatively insensitive to uranium prices making the electricity costs very stable over the entire life of the plant.

- Very low carbon energy source

So do we want a low marginal cost, reliable, and of most importance – stable cost alternative as part of the mix? Well, given that we don’t know what gas prices will be, we do know one thing – that fossil prices vary with time and hence no matter what, gas fired electricity prices will be volatile. So yes, I believe that having nuclear as part of the mix to help keep prices reasonable and stable is sensible and in the interest of consumers.

But all that being said, the future is up to us in the industry. While we can’t control the cost of gas, we must do our best to continue to reduce the cost of new nuclear as we gain the benefits of series build, including learning lessons from China and elsewhere where these benefits are being proven. And we must be able to demonstrate that we can build plants on time and on budget – and the rest will follow.

Wishing you all a very happy new year and thank you for reading my blog! Looking forward to more interesting discussion in 2013.

2 Comments

Meredith Angwin · December 30, 2012 at 3:21 pm

Excellent post!

The price of electricity on the grid is closely tied to the price of natural gas. In the Northeast, great excitement about low gas prices is leading to over-dependence on short term contracts. This leads to the strong possibility that rising gas prices will be quickly reflected in soaring electricity prices.

http://www.vnews.com/home/3041109-95/vermont-power-price-prices

Rod Adams · December 31, 2012 at 12:00 pm

Natural gas prices are more volatile when the available supply is closely matched to the underlying demand. That situation makes the marginal price skyrocket anytime there is any kind of interruption – like a hurricane hitting Gulf production platforms and pipeline compressor power supplies – because natural gas users are relatively insensitive to price. They cannot make a substantial reduction, for example, in their home heating just because the price spikes.

Electricity production companies are perhaps the least price sensitive customers in the gas system – at least over a short term. If the price spikes, but gas turbines are required to meet electricity demand, they will pay whatever price is demanded rather than run out of fuel and have to implement blackouts. In some juridictions, they are REQUIRED to take that action.

A really effective way to ensure gas prices remain well behaved is to ensure there is plenty of alternative sources of heat and power.

Herein lies a conundrum – if we build ample supplies of new nuclear power plants under an assumption that gas prices will rise, we are almost guaranteeing that we will be wrong. The increased supply of nuclear will help to keep gas prices down.

As nukes, our job is to work hard to build high quality, reliable plants that can be safely and profitably operated even in a low gas price environment because if we do our job correctly, we will be guaranteeing that nat gas prices remain low due to competition from substantially lower marginal cost nuclear.

One of the reasons that John Rowe has been so negative about the impact of low gas prices on nuclear energy is that he WANTS to sell low cost nuclear power in a high electricity price market. That is a scenario where even a company run by a trained chimp can make a profit.

Comments are closed.