Tackling market reform to enable nuclear projects – The UK moves forward!

The UK is unique in its approach to the nuclear renaissance. Once the cradle of the nuclear industry, with some of the world’s oldest plants and research centres, the UK has mostly dismantled its nuclear industry in recent years. From privatizing British Energy to selling off Westinghouse and dismantling BNFL, it is fair to say that the industry has been through the ringer. Yet, all of this restructuring has been in a context of encouraging the next round of nuclear new build to replace the current rapidly aging nuclear fleet, and meet both carbon reduction and security of supply targets over the next 40 years.

The thrust of the industry restructuring has been to get government out of the way and encourage private sector leadership for the next round of nuclear new build. This is totally consistent with UK policies on electricity generation. The UK was one of the first countries in the world to privatize electricity supply and today has a vigorous and effective private sector electricity generation infrastructure.

The path to new build nuclear has not been a fast one. Numerous consultations since 2003 have slowly moved the issue forward. The last one set in motion the Generic Design Assessment process with the regulator and the government’s move to simplify and improve the planning process. But one thing has been a constant throughout. Government has stated that it will move out of the way, and that it will be up to the private sector to implement nuclear new build. Definitely a challenge, but the evidence to date is positive as the success of the site auctions shows.

But now, the most important piece of the puzzle has been launched. In November of last year, government initiated a consultation on electricity market reform. This consultation is due to close in early March. It is this topic that I want to discuss today.

First of all, there is a very important statement in the consultation – it makes it clear that the current market structure is based, and was developed, to suit gas fired generation. To quote “the high capital costs and low operating cost of low-carbon generation are not well suited to the UK market where gas is the marginal plant. This is because gas is generally the price setting plant and can pass through any changes in gas or carbon prices to the electricity price. Therefore electricity and gas prices (and hence revenues and costs) tend to move together. By contrast low-carbon generators are price takers and are more exposed to gas or carbon price volatility.” High capital cost, low operating cost nuclear plants are at a considerable disadvantage in this type of market.

The objectives of government are: security of supply, decarbonisation and affordability. Meeting these objectives the four broad principles of cost effectiveness, durability and flexibility, practicality and coherence will be used to judge the effectiveness of different market design options.

The four elements of change under consideration in this consultation are:

– Carbon price support where the price of carbon is maintained to provide more incentive to low carbon options

– Feed in tariffs to guarantee revenues to specific generation types to provide the certainty necessary to support the project financing

– Capacity payments to ensure that adequate capacity is built to ensure security of supply

– Emissions performance standards which simply prohibits plants from emitting more than a maximum amount of carbon.

It is generally the first two items that we will discuss here as these are the ones that help to support nuclear power plants. First and simple to understand is the concept of a minimum carbon price. This provides an institutionalized economic advantage to low carbon generating options such as nuclear power.

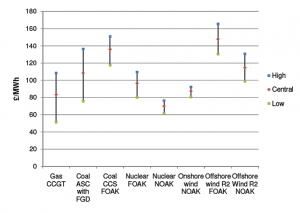

The bigger issue for nuclear is the potential use of Feed In Tariffs to provide market support to nuclear. While often used around the world for renewable projects, this is the first time a market is suggesting that feed in tariffs be used for large projects such as nuclear plants. Feed in tariffs are used to support renewables primarily because these plants are not sufficiently economic to compete in the market thus requiring subsidy in the form of tariffs that are usually significantly higher than the market price. This is not the case for nuclear. As shown in the figure above, nuclear plants are indeed competitive with the alternatives. It is their risk profile that is the issue. So the real question becomes – will a feed in tariff be sufficient to incentivize new build nuclear plants?

To answer this question, we must first discuss the nature of nuclear projects. They are different than renewable projects in that they not only have relatively high capital costs, but they also have very long project schedules – and this is the difference that matters. Why? Because taking 10 to 15 years from planning to in-service offers up a very different risk profile than a wind project that takes two years to build. This is why it is difficult to enter the market. The timetable is just too long and the price of electricity so many years in the future is too uncertain. So the question becomes – can a nuclear generator adequately predict the electricity price he needs to be profitable so far in advance? And then will a fixed tariff be the right solution?

Another way to look at it is to consider the risk I like to call “completion risk”. This is the overall risk of bringing in the plant on time and on budget. A nuclear project can only proceed when there is a willing party to take on this risk. So while price certainty helps, it does not do much good if the project is late and over budget. This means the owner can lose substantial money if the plant is late and/or over budget – or in the extreme to lose the entire investment in the case where the plant is never completed. This is the best way to gain understanding into this issue. Having certainty for the price of electricity does no good if electricity is never produced. This is why a power purchase agreement or a feed in tariff is not sufficient to raise financing on a non recourse project basis. Someone must take the completion risk.

In the US, this issue is clearly understood. This is why they have turned to a loan guarantee as the mechanism for project support. This works as it protects the owner from project failure limiting his risk to the equity in the project (usually around 20% in this case). This does not eliminate the completion risk but it mitigates it sufficiently to encourage new build projects to proceed. I am not commenting on whether or not an owner should be protected as this is a matter of policy; but what is clear is that no company will risk bankruptcy over a single project.

Does this mean that a feed in tariff should not be part of the solution? Not at all. It can be an important part of a package that helps to reduce the risk of a large nuclear project. In this case the UK is recommending a “contract for difference” model where the nuclear plant operates in the market and collects a difference if there is a shortfall from its agreed tariff and reimburses most of the overage if the market price exceeds the agreed tariff. Now indeed this is a complex model and gives the illusion of operating in the market when in fact, the opposite is true. What is actually being done is a continuous comparison to the market to illustrate how well the pre-agreed price compares with the market price.

In the case of project delay or overruns, the owner can lose substantial amounts of money, even if the market price of the day has risen significantly compared to what was anticipated as the electricity price will be limited to the pre-agreed tariff. I would suggest some flexibility to allow the operator to enjoy a larger portion of the upside in this case to recoup his losses.

The other big issue with all of this is that the market soon ceases to be real as more and more of the operating plants operate outside of it as the system is decarbonized. Do we really want a market and then have, say 80%, of the plant operate at pre-agreed prices ? In this case, how can the market price really reflect the system?

As you can see there are many issues when devising a way to modify the markets to meet these needs and there is lots of work to be done to get to the right answer. But what is important here is the clear understanding that current market design is suitable for gas but not necessarily for other sources of generation, primarily those with high capital costs and longer project schedules even though they’re economically competitive. It is great to see this important discussion on market redesign begin.